Ethereum Price Prediction: $4K Breakout Likely as Institutions Accumulate

#ETH

- Technical Convergence: Oversold RSI and bullish MACD divergence suggest impending reversal

- Institutional Adoption: Corporate treasuries and ETFs creating structural demand

- Regulatory Tailwinds: SEC's staking guidance removes key uncertainty for investors

ETH Price Prediction

Ethereum Technical Analysis: Short-Term Bearish, Long-Term Bullish Signals Emerge

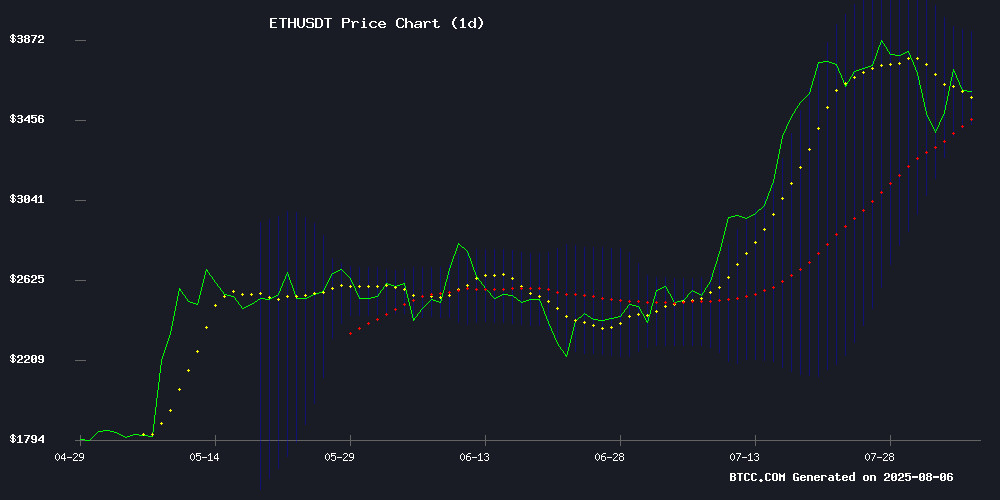

BTCC financial analyst John notes that ETH is currently trading below its 20-day moving average (3673.29 USDT) at 3575.26 USDT, indicating short-term bearish pressure. The MACD histogram shows bullish momentum building (-35.97 vs -218.05 signal line), while Bollinger Bands suggest potential volatility with price NEAR the lower band (3427.74).

Institutional Demand and Regulatory Clarity Fuel Ethereum Optimism

"The SEC's guidance on liquid staking and corporate treasury adoption are game-changers," says BTCC's John. With SharpLink becoming the largest corporate ETH holder and BitMine's $3B position, institutional accumulation aligns with technical indicators suggesting an eventual breakout above $4,000.

Factors Influencing ETH's Price

Ethereum's Hidden Signals Hint at Imminent $4K Breakout

Ethereum is capturing market attention once again, trading near $3,533 after an 8.6% weekly decline. Beneath the surface, however, on-chain data and trader positioning suggest a potential bear trap—setting the stage for a rally.

Whale wallets increased ETH holdings by 1.82% over 30 days, mirroring retail investors' 1.87% accumulation. This synchronized accumulation contrasts with mid-tier holders offloading positions—a classic redistribution pattern preceding major price movements.

IntoTheBlock's wallet behavior metrics reinforce the bullish thesis, indicating strategic positioning by savvy investors while weaker hands exit. The $4,000 resistance level now looms as a psychological battleground.

SEC Guidance on Liquid Staking Paves Way for Crypto ETFs

The U.S. Securities and Exchange Commission's latest staff guidance has removed a critical barrier to including staking mechanisms in spot cryptocurrency ETFs. Market participants interpret this as a precursor to regulatory approval for staking-enabled Ethereum ETFs, with liquid staking tokens (LSTs) expected to play a central role in fund operations.

Nate Geraci, co-founder of The ETF Institute, characterized the development as clearing the 'last hurdle' for staking integration. The SEC's Corporation Finance Division clarified that liquid staking arrangements under proposed structures wouldn't constitute securities offerings, with staking receipt tokens (SRTs) being classified as asset receipts rather than securities.

Industry experts highlight LSTs' dual advantage: maintaining exposure to staking rewards while preserving liquidity through transferable tokens. Jito Labs CEO Lucas Bruder praised regulators for demonstrating 'nuanced understanding' of modern staking architectures, anticipating rapid development of fully-staked ETF products following the guidance.

SharpLink Rebrands as Largest Corporate ETH Holder, Explores Yield Strategies Beyond Staking

SharpLink Gaming, formerly a sports betting affiliate technology provider, has pivoted to become the world's largest corporate holder of Ether (ETH). The rebranding follows a $425 million private placement led by ConsenSys, with Ethereum co-creator Joseph Lubin now chairing SharpLink's board. The company's ETH treasury, valued at approximately $1.65 billion, is staking a significant portion while actively exploring restaking and DeFi protocols for yield generation.

Co-CEO Joseph Chalom emphasizes Ethereum's transformational potential, positioning SharpLink as an active operator within the ecosystem rather than a passive holder. The strategic shift reflects institutional confidence in ETH's role in tokenization, stablecoins, and the broader financial infrastructure.

Institutional Accumulation Drives Ethereum Bullish Sentiment

Three newly created wallets have acquired 63,837 ETH worth $236 million through over-the-counter (OTC) transactions, signaling continued institutional interest in Ethereum. This follows a broader trend of accumulation, with fourteen fresh wallets purchasing 856,554 ETH ($3.16 billion) since July 9.

Historical data suggests Ethereum averages 64.2% gains in August following Bitcoin halving events, fueling analyst predictions of $5,000-$10,000 price targets. SharpLink Gaming notably added 18,680 ETH ($66.63 million) to its holdings, now totaling 498,711 ETH ($1.81 billion).

The OTC purchasing pattern avoids market impact while demonstrating sustained institutional confidence. Market observers note this accumulation occurs despite periodic volatility, with Ethereum's August performance historically benefiting from post-halving momentum.

Ethereum (ETH) Price Prediction: Strategic Reserve Surge Signals Institutional Confidence

Ethereum's market dynamics reveal a striking divergence between bullish on-chain activity and hesitant price action. The cryptocurrency briefly touched $3,730 before settling at $3,639, fueled by BitMine Immersion Technologies' $3 billion accumulation—now ranking as the fourth-largest crypto treasury globally.

Whale activity has reached fever pitch, with 14 new addresses acquiring 856,000 ETH worth $3.16 billion in just 48 hours. This accumulation spree coincides with Santiment data showing growing long-term holder conviction, as wallets containing 10,000+ ETH continue multiplying.

Most compelling is the Strategic Ethereum Reserve's explosive growth—ballooning from $3 billion to $10.8 billion in six weeks. This 2.45% supply lockdown by institutions suggests building momentum for potential upside, with technical analysts eyeing the $6,000 threshold.

Juror's Birthday Conflict Disrupts Tornado Cash Co-Founder's Trial Deliberations

The high-profile trial of Tornado Cash co-founder Roman Storm took an unexpected turn when a juror requested a pause in deliberations to attend her mother's birthday celebration. US District Judge Katherine Polk Failla denied the request, forcing the jury to adjust their schedule to morning-only sessions.

Legal analysts highlight the stark contrast between Storm's potential decades-long prison sentence for creating immutable smart contract code and the juror's personal scheduling conflict. The incident has raised concerns about potential biases and distractions affecting the trial's outcome.

This development comes amid ongoing scrutiny of cryptocurrency privacy tools and their developers. The case continues to draw attention from both legal experts and the crypto community, with many viewing it as a precedent-setting moment for decentralized technology.

SEC Clarifies Stance on Liquid Staking, Exempts Participants from Securities Disclosures

The U.S. Securities and Exchange Commission issued a staff statement affirming that liquid staking participants—including depositors and protocol providers—need not comply with securities law disclosures. The guidance specifically addresses arrangements where users deposit "covered crypto assets" with third-party staking providers in exchange for receipt tokens.

Liquid staking, a $67 billion sector dominated by Lido's $31.7 billion in total-value-locked, enables proof-of-stake blockchain participation while maintaining liquidity through derivative tokens. Market reaction was muted, with tokens like Lido's stETH showing marginal gains before retreating alongside broader crypto markets.

While not formal rulemaking, the statement signals regulatory thinking on an increasingly critical DeFi primitive. The SEC previously addressed other staking models in separate guidance, maintaining its case-by-case approach to crypto oversight.

Ethereum Price Prediction 2030: Assessing the $10K Potential

Ethereum commemorated its 10-year anniversary in July 2025, solidifying its role as the backbone of Web3 innovation. The network’s smart contract capabilities and DeFi dominance continue to attract institutional interest, with scalability upgrades like proto-danksharding fueling long-term optimism.

As of August 5, 2025, ETH trades at $3,676—a 5.2% daily gain offset by a 2.9% weekly decline. The asset recently tested resistance near $3,945 before retracing, demonstrating characteristic volatility amid broader market fluctuations.

Analyst projections for 2030 span a staggering range from $5,800 to $47,000. The $10K threshold emerges as a psychological benchmark, contingent not just on technological improvements but on Ethereum’s ability to narrate its evolution as the settlement layer for decentralized economies.

SEC Declares Some Liquid Staking Activities Are Not Securities in Key Crypto Guidance Update

The U.S. Securities and Exchange Commission (SEC) has issued a pivotal clarification on liquid staking, determining that certain activities in this sector do not constitute securities offerings. This guidance marks a significant step toward regulatory clarity for the crypto market.

Liquid staking allows crypto holders to stake assets via blockchain protocols or third-party providers, receiving tokens as proof of ownership and potential rewards. The SEC's statement emphasizes that these tokens do not automatically qualify as securities, depending on the specifics of the activity.

The announcement is expected to bolster confidence in staking services, particularly for protocols involving Ethereum (ETH) and other proof-of-stake blockchains. Market participants have long awaited regulatory clarity, which could now accelerate institutional adoption of staking mechanisms.

The New Frontier of Digital Assets: NFTs Pivot from Speculation to Utility

Non-Fungible Tokens (NFTs) have transcended their origins as digital art collectibles, emerging as verifiable certificates of ownership for a broad spectrum of digital assets. Built on blockchain technology, these unique tokens offer immutable proof of authenticity, enabling secure transfers and trades without intermediaries.

The NFT market has matured significantly since its speculative peak in 2022. By September 2023, over 95% of collections held no monetary value—a sobering correction that catalyzed a shift toward functional applications. The convergence with DeFi protocols, GameFi ecosystems, and metaverse platforms now drives the sector's next growth phase.

Smart contracts underpin this evolution, creating transparent ownership records while enabling complex financial interactions. As the space moves beyond JPEG trading, projects leveraging NFTs for tangible utility—from fractionalized real-world assets to gaming interoperability standards—are attracting institutional interest.

BitMine’s ETH Holdings Surpass $3B Amid Ethereum Rally

BitMine, a leading digital asset management firm, now holds over $3 billion in Ethereum as the cryptocurrency's price surges 6% to break above $3,600. The firm added 208,137 ETH last quarter, bringing its total holdings to 833,042 ETH—solidifying its position among the top institutional holders globally.

Ethereum's rally reflects renewed institutional confidence, driven by growing DeFi activity, anticipation of spot ETFs, and the network's roadmap for scalability. Analysts note a shift in perception—financial institutions increasingly view ETH as more than a speculative asset, recognizing its utility in smart contracts and staking ecosystems.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $5,800 | $7,500 | ETF approvals, EIP upgrades |

| 2030 | $8,000 | $12,000 | $25,000 | Enterprise adoption, scaling solutions |

| 2035 | $15,000 | $30,000 | $50,000 | Tokenized economy maturity |

| 2040 | $25,000 | $60,000 | $100,000+ | Global reserve asset status |

John emphasizes these projections assume continued network development and regulatory clarity.